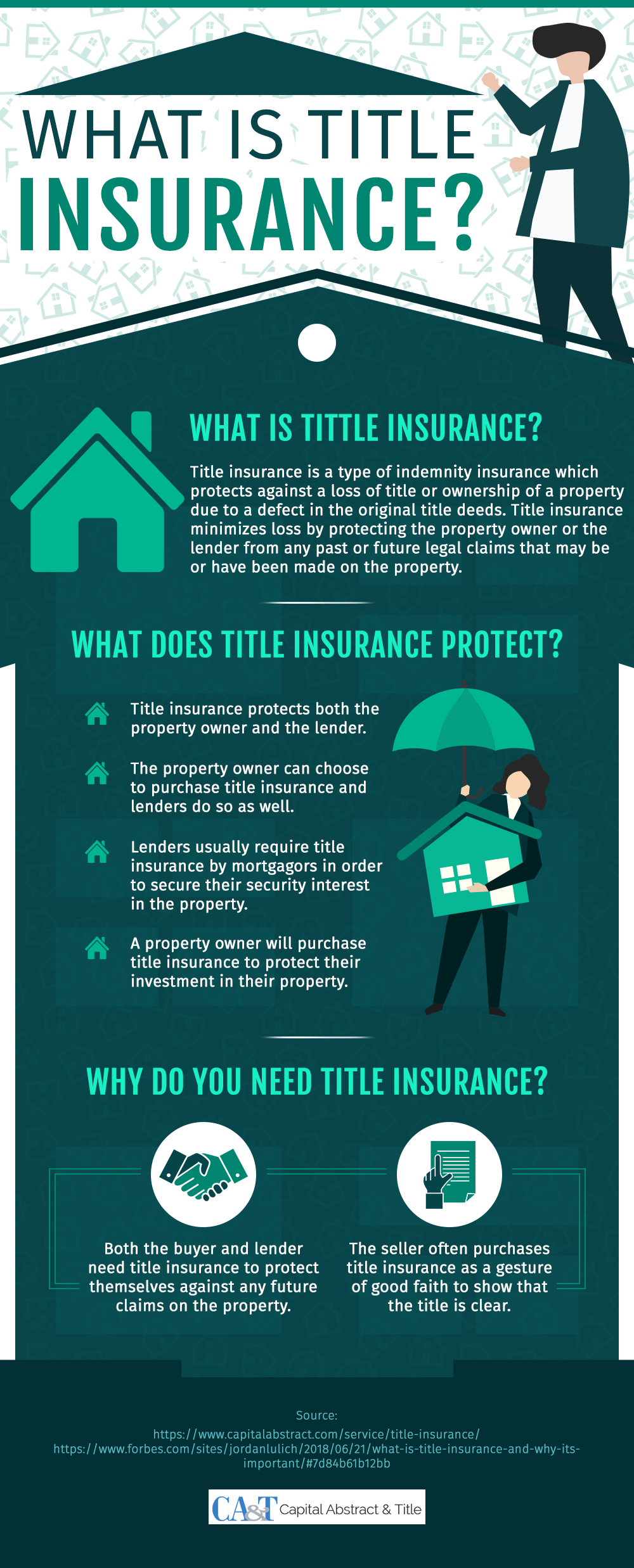

This infographic titled ‘What is Title Insurance’ explains the meaning, scope, and benefits of a title insurance. Title insurance is a type of indemnity insurance that protects against the loss of title or ownership of a property due to a past claim or fault in the original property deed. It minimizes the holder’s loss from any legal claims on the property title made in the past and may occur in the future.

The scope

What does title insurance cover and who does it protect?

Title insurance protects both the property owner and the lender. Either party can choose to buy the insurance to cover their investment. Quite often, lenders make it a condition for the mortgage. By protecting the interests of the property owner, a title insurance also protects the lender’s investment. Even without the mortgage condition, a property owner may choose voluntarily to buy the insurance.

The benefits

Protection: The main reason property buyers and lenders buy insurance is to protect themselves against any future claims on the property. Such claims could result from a fault in the original property deeds, outstanding liens, debts or some past claimant. Such claims are usually investigated through title searches. But even the most diligent and thorough title searches could miss details. If the claim surfaces in the future, it could threaten the owner’s title. Title insurance covers the buyer against any such eventuality.

A gesture: Typically, title insurance is bought by buyers and lenders. But in some cases, a seller may also buy title insurance. This is usually done as a gesture of good faith. Through the insurance, the buyer shows that his/her ownership of the property is clear. Furthermore, it is covered against any loss.

For more information, please refer to the graphic below.