Buying a property is an expensive business. In most cases it means the investment of one’s entire savings with an additional loan in the future. Buying insurance from a Parkland title insurance company, especially if you are not very clear about why you should buy it in the first place is crucial.

What is title insurance?

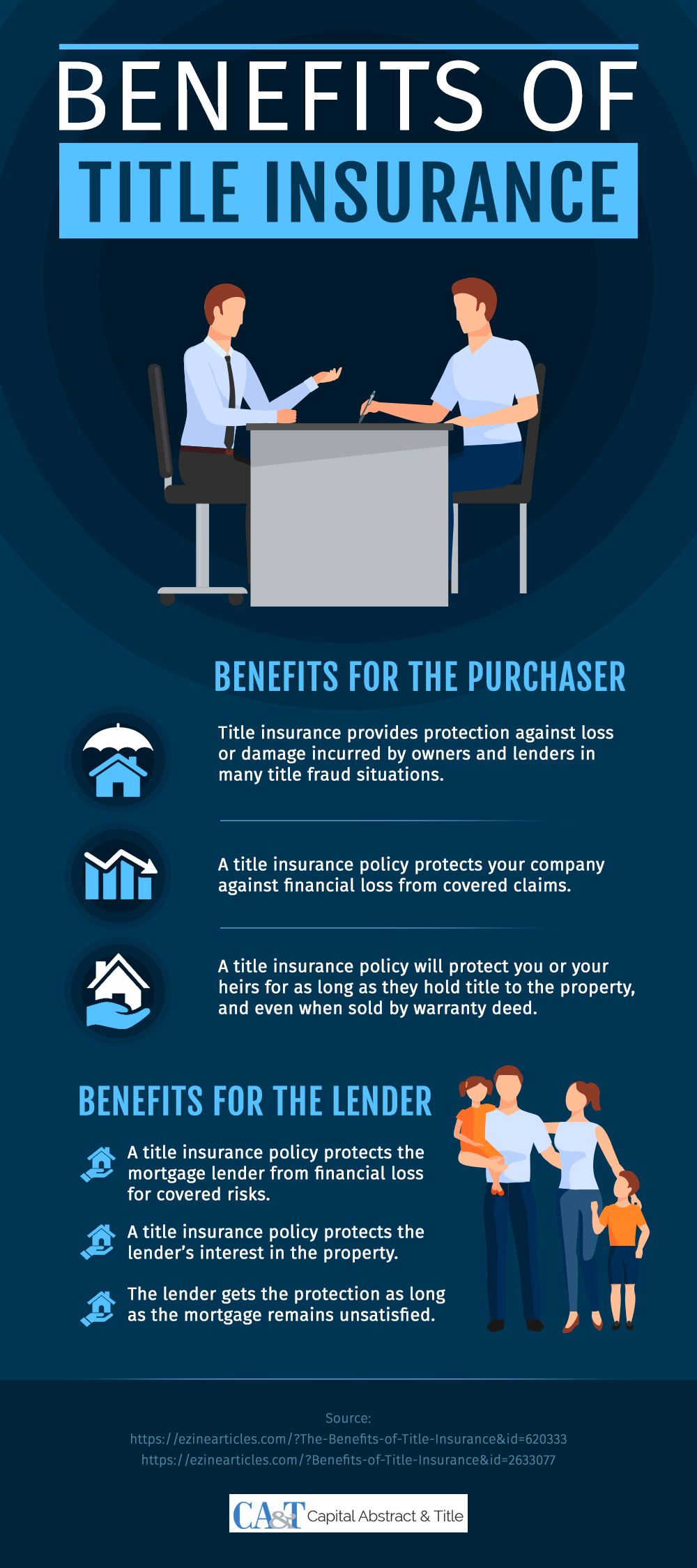

A title is equivalent to your ownership of the property. Any fault in the title can jeopardize your ownership and with it, your entire investment. Title insurance protects you against any losses that arise from a fault in the title of the property. Unlike most other insurances that protect you against an accident in the future, title insurance protects you against something which has already happened.

If it has already happened, why should you bother about insurance? Here’s why:

Title search: You can do a title search by checking with the recorder of deeds on your own but this is far from enough. Mistakes can and do happen. There are a number of cases where a deed was not recorded or there was a fault in the record. There could also be outstanding debts or liens against this property. Most of us simply do not have the resources to do a thorough title search. A title insurance company, on the other hand, does have these resources and will always carry out a comprehensive title search before issuing the insurance.

Recover your losses: What happens if a fault in the title appears despite due diligence? Your focus must then shift to ensure that your losses are minimized. A title insurance becomes critical in this case.

Lender’s condition: Any threat to your ownership also risks a lender’s investment in the property. Many lenders make insurance from a reliable Parkland title insurance company part of their lending conditions.