![[Infographic] Title Insurance Attorney - An Overview](https://www.capitalabstract.com/wp-content/uploads/2022/02/Title-Insurance-Attorney-An-Overview-scaled.jpg)

Category: Title Insurance

[Infographic] Key Importance of a Title Insurance Policy

![[Infographic] Key Importance of a Title Insurance Policy](https://www.capitalabstract.com/wp-content/uploads/2022/01/Key-Importance-of-a-Title-Insurance-Policy-scaled.jpg)

What Is Title Insurance Good For?

If you are taking out a mortgage to buy a house, then the lender will probably ask you to get title insurance for the new property. Title insurance will protect both the mortgage lender and buyer from financial losses, which may occur due to legal expenses if there is an issue with the title of the property or home you are purchasing.

Having title insurance protects you from all kinds of issues, which occurred before becoming the owner. This means that you don’t have to worry about forged title documents, ownership issues, or unpaid debts from previous owners.

Types Of Title Insurance

There are two different types of title insurance available out there, lender’s title policy and owner’s title policy. The former type of title insurance policy protects the lender while the latter offers protection to the home buyer.

The mortgage lender will ask you to get an insurance policy on their behalf. However, it is best to get the owner’s title policy too, it will help you safeguard your investment against unforeseen title issues.

Individuals who are new to the world of title insurance might have a few doubts and questions. For starters, they would want to know what title insurance covers. Title insurance usually covers the following.

- Fraud or Forgery

- Unknown heirs to the home or property

- Liens, which precede the new owner

- Missing information

- Inconsistent wills

- Defective paperwork such as improper recording from closing and escrow

- illegitimate selling or transferring of the deed

Just like all other types of insurance, you will be able to expand your existing insurance coverage for a smaller price through policy endorsements. Endorsements usually include zoning violations, border disputes, building ordinance violations, and more.

What Does an Owner’s Title Policy Cover?

When you are buying a new home, you will most likely receive a document, which is known as the deed. The deed will clearly show that the previous owner of the house has transferred their title or legal ownership to you. An owner’s title insurance policy will offer protection to homeowners if someone sues them, arguing that they have a claim against the property or home before the homeowner purchased it.

Most lenders will ask you to buy a lender’s title insurance policy. However, it is crucial to remember that a lender’s title insurance policy will only safeguard the money that the bank has given you for refinancing or a mortgage. This means that a lender’s title insurance policy will not protect any kind of equity you have in the home.

On the other hand, the owner’s title insurance will protect you when someone files a lawsuit with a claim to the deed of the purchased house. This is why all homeowners should consider investing in a title insurance policy.

How Can an Owner’s Title Policy Protect You?

Several homeowners often fail to realize the fact that potential claims against the title of their home may date years back, long before you purchased it. So, if you don’t have an owner’s title insurance policy, you are in big trouble.

Homeowners who are new to the world of title insurance policies often ask what the types of claims are filed against the title. Here are a few examples.

- Disagreement regarding the property lines

- Dispute on whether the previous seller had the right to sell the home to you or not

- Discovery of undisclosed lawsuits or liens against the home or property

How Does Title Insurance Work?

Buying a home will be one of the largest purchases that most people make in their lives. If you are one of them, then you wouldn’t want to face any issues regarding the ownership of the title or house after completing the transaction. This is where title insurance companies can be great help to you.

Title insurance does an excellent job of protecting mortgage lenders and homeowners against problems or defects with the title during the property ownership transfer. If a dispute happens regarding the title after or during a sale, then the title insurance company will need to pay for legal damages based on the insurance policy.

How Does Title Insurance Work?

Homeowners must understand that obtaining title insurance is a two-step process. The title insurance company will initially conduct a title search to ensure that the house or property that you are planning to buy has a clear title.

Confirming that it does have a clear title will guarantee that the individual who is selling it truly owns the property and they have the right to sell it. If an issue or defect comes up, then the title insurance company will let you know about it.

Once the title company confirms that the property has a clear title or when they identify issues with the title, then they will start the underwriting process. The underwriting process involves addressing issues and potential risks and then provide a quote.

It is important to note that insurance companies might not offer a policy if there are any defects or issues with the title. Get in touch with us to learn more about how title insurance really works.

Things To Know About Title Endorsement

Title insurance offers great protection to your property when you have to face unknown defects in the title. Most title agents usually add endorsements to the title insurance policy. This is usually done to tailor the policy according to the needs and requirements of both the buyer and lender. The ALTA (American Land Title Association) is responsible for managing title policy endorsements.

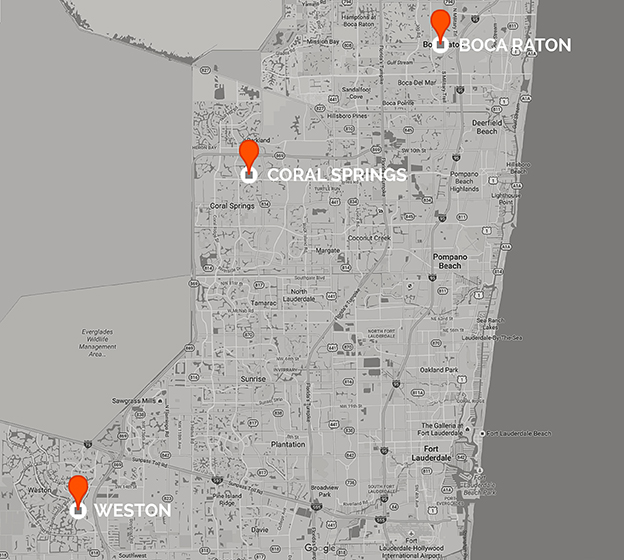

If you are new to the world of title insurance and title endorsement, it is best to get in touch with experts at a Boca Raton Title Endorsement firm. They will help you gain a clear understanding of title endorsement and help you determine whether you need it or not.

A Beginner’s Guide to Title Policy Endorsement

It is crucial to note that title insurance policies are actually form documents. This means that title endorsements will be able to stipulate certain special circumstances that may affect the property. Title policy endorsements will surely be needed in situations where the titles are considered to be clouded (no one clearly knows who is the true property owner).

In such scenarios, title insurance policies can be used to customize or tailor the title based on the situation. As a result, title policy endorsements will be able to change the stipulations, conditions, and exceptions of a basic title insurance policy.

In addition to that, title policy endorsements will also be able to alter or correct the previously issued or existing title insurance policy for making up for misinterpreted or left-off things.

If you are still unable to decide whether you need title policy endorsement or not, it is best to seek the help of a reputed Boca Raton Title Endorsement firm. The experts at the firm will be able to give you further assistance.

Looking for a Title Insurance Agency? Read This!

Are you planning to buy a house? It is a demanding process. A substantial amount of money goes into buying a house. You may be pooling all of your savings to purchase your dream house. When a huge amount of money is at stake, you would not want anything to go wrong. Finalizing the purchase of your dream house is all you would want. So, choose a title insurance agency in Boca Raton to finalize the deal.

The title insurance agency will be responsible for verifying the title of the property and closing the deal. An agency will simplify the purchasing process for you. Before you select an agency, consider the following:

- Reviews: Reviews and testimonials will tell you a great deal about the agency. Just search the agency’s name on Google, and you will come across a plethora of reviews. At times, even the agency websites include testimonials and reviews from the clients. Reviews will allow you to gather information about the agency’s performance.

- Quotes: Many people choose to rely on title quotes received from only one agency. You should not make the same mistake. Ask for quotes from multiple agencies. Compare the quotes and choose the one that fits your budget.

- Responsiveness: How much time does it take the agents to address your questions? Can you reach out through calls, e-mail, or any other way? Are they willing to ease your doubts? If they respond after a long time or reply randomly, recognize these warning signs and do not hire them at any cost.

- Experience: Would you want an inexperienced agency to handle your case? Agencies with years of experience can handle your case efficiently. They know the process like the back of their hands and can deal with any problems tactfully. Go for an agency that has vast experience in the field.

We, at Capital Abstract & Title, are known for our top-notch services. We have more than three decades worth of experience in the industry. You can conclude your search for a title insurance agency in Boca Raton.

Types Of Title Insurance

Title insurance is a necessary and in-depth form that ensures greater protection to both the parties who are involved in the process of buying a home. Both the buyer and seller would like to ensure that the home buying process goes as smoothly as planned. This is why it is important to get title insurance.

Most sellers and buyers might not know a lot about title insurance. In fact, several people will be surprised to hear that there are two different types of title insurance. If you want to know more about title insurance, you should consult with an experienced real estate title insurance lawyer.

Types Of Title Insurance

There are two different types of title insurance policies and they are as follows:

- Seller’s Title Insurance Policy

- Buyer’s Title Insurance Policy

Seller’s Title Insurance Policy

A Seller’s title insurance policy may also be referred to as a loan policy or lender’s policy. The primary aim of this title insurance policy is to offer protection to the lender who has provided funds for a property. This will include a number of things like defects in the title, unrecorded liens, and more.

Buyer’s Title Insurance Policy

This type of title insurance policy is for the individual who is buying the home or property with the intent of owning the title completely one day. This means that the buyer’s title insurance policy will protect the buyer. So, if you are someone who is planning to buy a property or home, it is best to get this title insurance policy.

Final Thoughts

If you are new to the world of title insurance policies, it is best to get in touch with a professional real estate title insurance lawyer before buying any insurance, as it will help you get a better idea of the different types of title insurance policies.

A Beginner’s Guide To Title Insurance Agencies

If you are someone who has been involved in a real estate transaction, then you will be familiar with title insurance agencies. It is evident that title insurance agencies play an integral role when it comes to real estate transactions. However, several people still have no clear idea on what exactly these companies do.

In simple words, title insurance companies simplify the process of real estate transactions by offering complex research and ensuring professional coordination with all parties involved in the transaction. If you want the real estate transaction to go smoothly, it is important to seek the help of title insurance agency Boca Raton.

Records Search

Professional title insurance companies conduct extensive research of country records. The research allows them to identify issues such as property liens, which may be attached to the title of the new property. Title insurance agencies usually consolidate the founded information into the title insurance agreement or preliminary report.

Insurance

Most of the title insurance companies in the country usually offer title insurance to buyers. The insurance coverage will be paying for issues that are identified during the research. The insurance cost is generally built into the real estate property’s closing cost. An important point to remember is that lenders will need title insurance before finalizing the real estate deal.

Closing

In some cases, title insurance agencies will act as escrow officers or closing agents during the purchase of a real estate property. This means that the title insurance company will be representing both the seller and buyer in the transaction.

Final Thoughts

If you are new to the world of real estate transactions or if you want to go the transaction smoothly, it is best to seek the help of title insurance agency Boca Raton, as the agency will help you to ensure that the transaction will go smoothly as planned.

Get title insurance to safeguard your property

Purchasing a property can be an instrument of joyous excitement. But to find out later that there are legal disputes with the property can be disheartening. Title Insurance Agency in Boca Raton can save you all these home ownership related issues. It gives you the much-needed protection that safeguards you and your property against any ownership disputes.

What can you do to safeguard the property you intend to buy?

1. Make sure to do a little bit of research yourself and find out whether there are any ownership disputes or liens against the property.

2. You can always hire a title search agent or a lawyer who can help find out any claims or disputes that are not disclosed.

3. Get title insurance. Title insurance is valid for 7 years, and after that, you can renew it too.

Title insurance: How can it help?

Title insurance is a blessing for the property buyers as they might not be able to discover all title disputes with the property even after thorough research. The title insurance agency would help make the real estate deal closure a smooth process with all loose ends covered.

Tips to help you find a reputable title insurance agency

1. Agency’s license status in the area where the buyer intends to purchase the property

2. Business history of the agency and the length of time it has been in the business

3. Local reputation of the agency and its knowledge about the area where the buyer intends to buy the property

4. Ease of communication with the agents

5. The overall behaviour of the staff members and willingness to help the buyer

6. Escrow services provided in-house

7. If there’s anyone from the agency having a direct connection with the notary public

8. Connection with the American Land Title Association or State Title Association

Make sure to hire a reputed Title Insurance Agency in Boca Raton so that you can get end-to-end support for any ownership-related disputes or tax-related issues.