![[Infographic] Key Importance of a Title Insurance Policy](https://www.capitalabstract.com/wp-content/uploads/2022/01/Key-Importance-of-a-Title-Insurance-Policy-scaled.jpg)

Category: Title Insurance Agency Boca Raton

What Does an Owner’s Title Policy Cover?

When you are buying a new home, you will most likely receive a document, which is known as the deed. The deed will clearly show that the previous owner of the house has transferred their title or legal ownership to you. An owner’s title insurance policy will offer protection to homeowners if someone sues them, arguing that they have a claim against the property or home before the homeowner purchased it.

Most lenders will ask you to buy a lender’s title insurance policy. However, it is crucial to remember that a lender’s title insurance policy will only safeguard the money that the bank has given you for refinancing or a mortgage. This means that a lender’s title insurance policy will not protect any kind of equity you have in the home.

On the other hand, the owner’s title insurance will protect you when someone files a lawsuit with a claim to the deed of the purchased house. This is why all homeowners should consider investing in a title insurance policy.

How Can an Owner’s Title Policy Protect You?

Several homeowners often fail to realize the fact that potential claims against the title of their home may date years back, long before you purchased it. So, if you don’t have an owner’s title insurance policy, you are in big trouble.

Homeowners who are new to the world of title insurance policies often ask what the types of claims are filed against the title. Here are a few examples.

- Disagreement regarding the property lines

- Dispute on whether the previous seller had the right to sell the home to you or not

- Discovery of undisclosed lawsuits or liens against the home or property

How Does Title Insurance Work?

Buying a home will be one of the largest purchases that most people make in their lives. If you are one of them, then you wouldn’t want to face any issues regarding the ownership of the title or house after completing the transaction. This is where title insurance companies can be great help to you.

Title insurance does an excellent job of protecting mortgage lenders and homeowners against problems or defects with the title during the property ownership transfer. If a dispute happens regarding the title after or during a sale, then the title insurance company will need to pay for legal damages based on the insurance policy.

How Does Title Insurance Work?

Homeowners must understand that obtaining title insurance is a two-step process. The title insurance company will initially conduct a title search to ensure that the house or property that you are planning to buy has a clear title.

Confirming that it does have a clear title will guarantee that the individual who is selling it truly owns the property and they have the right to sell it. If an issue or defect comes up, then the title insurance company will let you know about it.

Once the title company confirms that the property has a clear title or when they identify issues with the title, then they will start the underwriting process. The underwriting process involves addressing issues and potential risks and then provide a quote.

It is important to note that insurance companies might not offer a policy if there are any defects or issues with the title. Get in touch with us to learn more about how title insurance really works.

Looking for a Title Insurance Agency? Read This!

Are you planning to buy a house? It is a demanding process. A substantial amount of money goes into buying a house. You may be pooling all of your savings to purchase your dream house. When a huge amount of money is at stake, you would not want anything to go wrong. Finalizing the purchase of your dream house is all you would want. So, choose a title insurance agency in Boca Raton to finalize the deal.

The title insurance agency will be responsible for verifying the title of the property and closing the deal. An agency will simplify the purchasing process for you. Before you select an agency, consider the following:

- Reviews: Reviews and testimonials will tell you a great deal about the agency. Just search the agency’s name on Google, and you will come across a plethora of reviews. At times, even the agency websites include testimonials and reviews from the clients. Reviews will allow you to gather information about the agency’s performance.

- Quotes: Many people choose to rely on title quotes received from only one agency. You should not make the same mistake. Ask for quotes from multiple agencies. Compare the quotes and choose the one that fits your budget.

- Responsiveness: How much time does it take the agents to address your questions? Can you reach out through calls, e-mail, or any other way? Are they willing to ease your doubts? If they respond after a long time or reply randomly, recognize these warning signs and do not hire them at any cost.

- Experience: Would you want an inexperienced agency to handle your case? Agencies with years of experience can handle your case efficiently. They know the process like the back of their hands and can deal with any problems tactfully. Go for an agency that has vast experience in the field.

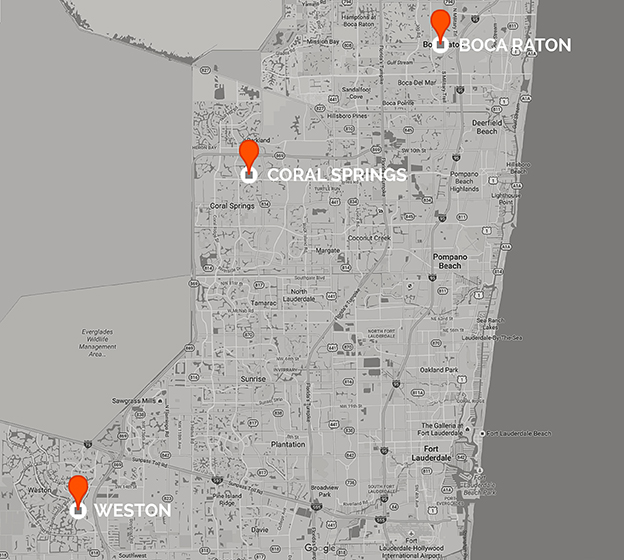

We, at Capital Abstract & Title, are known for our top-notch services. We have more than three decades worth of experience in the industry. You can conclude your search for a title insurance agency in Boca Raton.

Types Of Title Insurance

Title insurance is a necessary and in-depth form that ensures greater protection to both the parties who are involved in the process of buying a home. Both the buyer and seller would like to ensure that the home buying process goes as smoothly as planned. This is why it is important to get title insurance.

Most sellers and buyers might not know a lot about title insurance. In fact, several people will be surprised to hear that there are two different types of title insurance. If you want to know more about title insurance, you should consult with an experienced real estate title insurance lawyer.

Types Of Title Insurance

There are two different types of title insurance policies and they are as follows:

- Seller’s Title Insurance Policy

- Buyer’s Title Insurance Policy

Seller’s Title Insurance Policy

A Seller’s title insurance policy may also be referred to as a loan policy or lender’s policy. The primary aim of this title insurance policy is to offer protection to the lender who has provided funds for a property. This will include a number of things like defects in the title, unrecorded liens, and more.

Buyer’s Title Insurance Policy

This type of title insurance policy is for the individual who is buying the home or property with the intent of owning the title completely one day. This means that the buyer’s title insurance policy will protect the buyer. So, if you are someone who is planning to buy a property or home, it is best to get this title insurance policy.

Final Thoughts

If you are new to the world of title insurance policies, it is best to get in touch with a professional real estate title insurance lawyer before buying any insurance, as it will help you get a better idea of the different types of title insurance policies.

A Beginner’s Guide To Title Insurance Agencies

If you are someone who has been involved in a real estate transaction, then you will be familiar with title insurance agencies. It is evident that title insurance agencies play an integral role when it comes to real estate transactions. However, several people still have no clear idea on what exactly these companies do.

In simple words, title insurance companies simplify the process of real estate transactions by offering complex research and ensuring professional coordination with all parties involved in the transaction. If you want the real estate transaction to go smoothly, it is important to seek the help of title insurance agency Boca Raton.

Records Search

Professional title insurance companies conduct extensive research of country records. The research allows them to identify issues such as property liens, which may be attached to the title of the new property. Title insurance agencies usually consolidate the founded information into the title insurance agreement or preliminary report.

Insurance

Most of the title insurance companies in the country usually offer title insurance to buyers. The insurance coverage will be paying for issues that are identified during the research. The insurance cost is generally built into the real estate property’s closing cost. An important point to remember is that lenders will need title insurance before finalizing the real estate deal.

Closing

In some cases, title insurance agencies will act as escrow officers or closing agents during the purchase of a real estate property. This means that the title insurance company will be representing both the seller and buyer in the transaction.

Final Thoughts

If you are new to the world of real estate transactions or if you want to go the transaction smoothly, it is best to seek the help of title insurance agency Boca Raton, as the agency will help you to ensure that the transaction will go smoothly as planned.

4 benefits of title searching

When an individual intends to buy a property, it means they want to enjoy the right to use it and, in the future, transfer the ownership to their legal heir. A title can be obtained in several ways.

The survivorship right is one of the vital aspects where joint tenants let the surviving co-owner absorb the share of the deceased co-owner’s property.

However, a dispute arises when third parties like government organizations or mortgage institutes claim their rights. The government may have liens against unpaid taxes, while the bank may have loan dues. Here is where you need the help of a title search.

Title Search agencies near Boca Raton are quite well-equipped to unveil the property history without wasting any time.

Benefits of title searching

Through proper analysis of public records and other property-related documents, a professional title searcher tries to disclose the history and current status of the property. If a prospective buyer seeks a mortgage loan, the lender conducts a third-party title search to get the “clean” report.

Several issues can create trouble in the sale of the property, such as:

a. Forged or fake documents

Fraudsters may impersonate the trademarks and signatures of the legal property owners and try to create trouble.

b. Expired or fabricated power of attorney disputes

Illegitimate titles are owned by the individuals who have fabricated power of attorney documents or are carrying expired power of attorney documents.

c. Printing errors

The most common title disputes arise when the records/documents are not properly indexed, similar names are transcribed and the original documents are lost.

d. Illegal possession of the property

Disputes arise when the joint owners are separated but not divorced, or the property is owned by illegitimate successors.

Consider hiring professionals from the Title Search agencies located near Boca Raton to avail the best professional service and get the much-needed peace of mind.

Frequently Asked Questions on Title Insurance Policy

Do you wish to own a property without any property claim disputes? Do you want to get protection against any unwanted legal claims over the property you purchase? You can get a property with assurance or ‘warranty’ to get proper legal assistance against any property-related claim.

Title Insurance Agencies in Boca Raton can help buy the best title insurance policies without digging deep holes in your pocket.

If you are purchasing a property, it would be a great idea to buy a title insurance policy, as it can compensate you in any title-related disputes and also covers the legal expenses.

How long can the title insurance stay functional?

The lender’s policy for title insurance lasts until the mortgage amount is paid in full. The homeowners title insurance policy lasts until the owners and his/her successors are alive and stay interested in the property related matters.

Title insurance: what it doesn’t cover?

As a homeowner, you may complain that there’s oil leakage, dampness & mold, or a termite issue inside your home, and you may want to obtain compensation for that. But title insurance does not protect you against the home’s conditions. Rather, it deals with ownership related issues.

How to calculate the title insurance cost?

For the title insurance, all you need to pay is a one-time premium to keep all the ownership related disputes at bay. The cost of title insurance is calculated by the insurance agency’s cost (rate per thousand) multiplied by the property purchasing price.

Can you take ownership of a property without purchasing title insurance?

Of course, you can buy a property without any title insurance. You can look for the public records and do some research, but the entire process would take up a lot of your time and effort.

Consider hiring Title Insurance from a reputed Agency, located near Boca Raton, and have peace of mind when you purchase a local property.

Title Insurance Agency Boca Raton

Title insurance can help the homeowner resolve the ownership related disputes and title defects along with the required legal support to handle similar claims. Title insurance entitles you to get protection for 7 years against any such conflicts. If you wish to get your title insurance done, consider hiring services from Title Insurance Agency Boca Raton.

There are two types of title insurance policies.

Owner’s title insurance policy

The title insurance for the homeowners protects them against any legal title claim. The insurance provides legal and other assistance when someone sues the homeowner or says that they have claims on the property before the current owner’s purchase.

Lender’s title insurance policy

To protect their investment, lenders insure their property against fire and theft. Similarly, to protect their investment against any title-related disputes, title insurance is necessary.

What kind of title claims may arise?

1. Dispute on property inheritance.

2. Disagreements on the seller’s property selling rights.

3. Undisclosed lawsuits/liens discovered.

Benefits of title insurance

1. Covers the cost of litigation

Once the homeowners get title insurance, this would cover the litigation cost as well. Rest assured that legal expenses like documentation costs, settlement charges, legal procedure costs, etc. would be taken care of by the insurance company.

2. Saves your time, money, and effort

Insurance agencies also provide legal ‘out-of-the court’ settlement assistance and do whatever is legally needed to resolve the ownership dispute. Since the insurance company takes care of the cost and procedure, it can save your time money, and effort.

3. Protects the residential projects

Title insurance provides a protective shield to the developers and residential projects against any legal disputes. A residential project needs several months (or years) to complete, and if there’s any legal dispute discovered during the construction phase, it would be difficult for the developer to cover the costs.

No doubt, a title insurance policy is necessary for anyone who is dealing with real estate (property selling/lending/buying). To get the best quotes and hire the best lawyers, consider consulting Title Insurance Agency Boca Raton.