Buying a home is the biggest financial and emotional investment most of us will ever make. Still, so many people do it without a Title Attorney. Basically, they’re joining risk for a free fall.

Hiring a real estate attorney is critical to protecting your interests and your future. Real estate is riddled with paperwork, confusing clauses, rules and regs, and big problems disguised as tiny type.

A good Title Attorney is your advocate with a deep understanding of real estate law and all the pitfalls that might turn your dream home into a nightmare. Don’t take chances. Here are the Top 5 Reasons you need a Title Attorney.

#1 Clarity

Someone has to read all the documents and understand what it all means. Hiring an attorney from the onset of your real estate transaction to review all agreements and contracts and assist in negotiations will ensure the maximum level of transparency and comfort. Whenever you don’t understand a term or part of the process, you can rely on your lawyer to clarify any vague language and ensure your requirements are properly communicated, represented, and documented along the way.

#2 Savings

The upfront fees of hiring a real estate attorney are nothing in comparison to the possible financial impact of getting things wrong down the line. A real estate attorney will safeguard you and your investment by thoroughly reviewing all legal documentation, handling negotiations as your advocate, and asking the questions you may not know to ask. When it comes to dealing with one of the biggest investments of your life, the financial savings and knowledge a real estate attorney provides is priceless.

#3 Experience

Even if this is not your first real estate purchase, your real estate attorney has gone through this process more times than you ever will in a lifetime. They have the institutional knowledge of working daily in the industry and have their fingers on the pulse of state and local laws. It’s especially for those with unique real estate ventures, like new construction, zoning disputes or a historic location to have legal support to mitigate any risks that could delay, if not derail, the purchase.

#4 Closing

Though not every state requires a real estate attorney to be present at closing, all property buyers benefit from legal support. There are multiple moving parts to the closing process, including the mortgage, title insurance, the deed and final inspection. Hiring a lawyer to review, adjust and prepare all closing documentation is a huge weight lifted off your shoulders and ensures you and your assets are properly protected. Owning property is a big investment, and the security of an experienced attorney handling your closing will ensure a timely and successful transaction.

#5 Protection

A real estate attorney works for you, represents your needs, and will negotiate on your behalf during the real estate purchasing process. A good lawyer will walk you step-by-step through the complications of real estate transactions, and act as a safeguard, protecting you from problems and issues that the untrained eye simply cannot identify or predict. With the support of sound legal counsel, you enjoy the peace of mind that comes with knowing you, your family and your investments are protected.

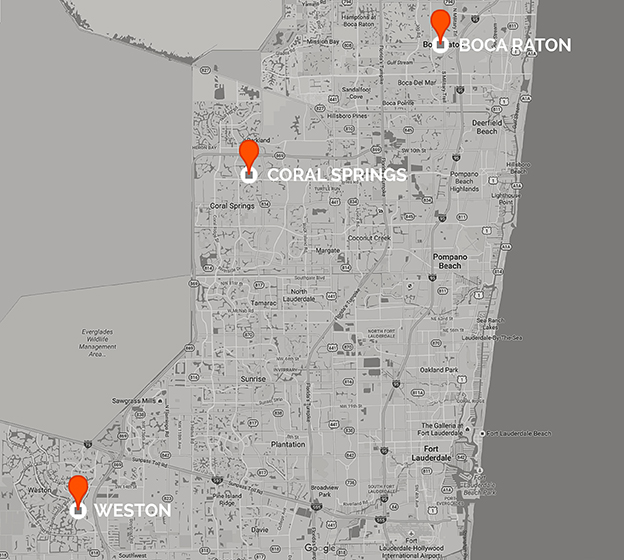

At Capital Abstract & Title, we take the unnecessary risk out of real estate purchases. To learn more about how we can support and protect you, give us a call at 954.344.8420 or visit us online at capitalabstract.com.

![[Infographic] E-Closing: The Easiest Way to Complete a Real Estate Closing](https://www.capitalabstract.com/wp-content/uploads/2022/09/Infographic-E-Closing-The-Easiest-Way-to-Complete-a-Real-Estate-Closing-scaled.jpg)

![[Infographic] Title Insurance Attorney - An Overview](https://www.capitalabstract.com/wp-content/uploads/2022/02/Title-Insurance-Attorney-An-Overview-scaled.jpg)

![[Infographic] Key Importance of a Title Insurance Policy](https://www.capitalabstract.com/wp-content/uploads/2022/01/Key-Importance-of-a-Title-Insurance-Policy-scaled.jpg)