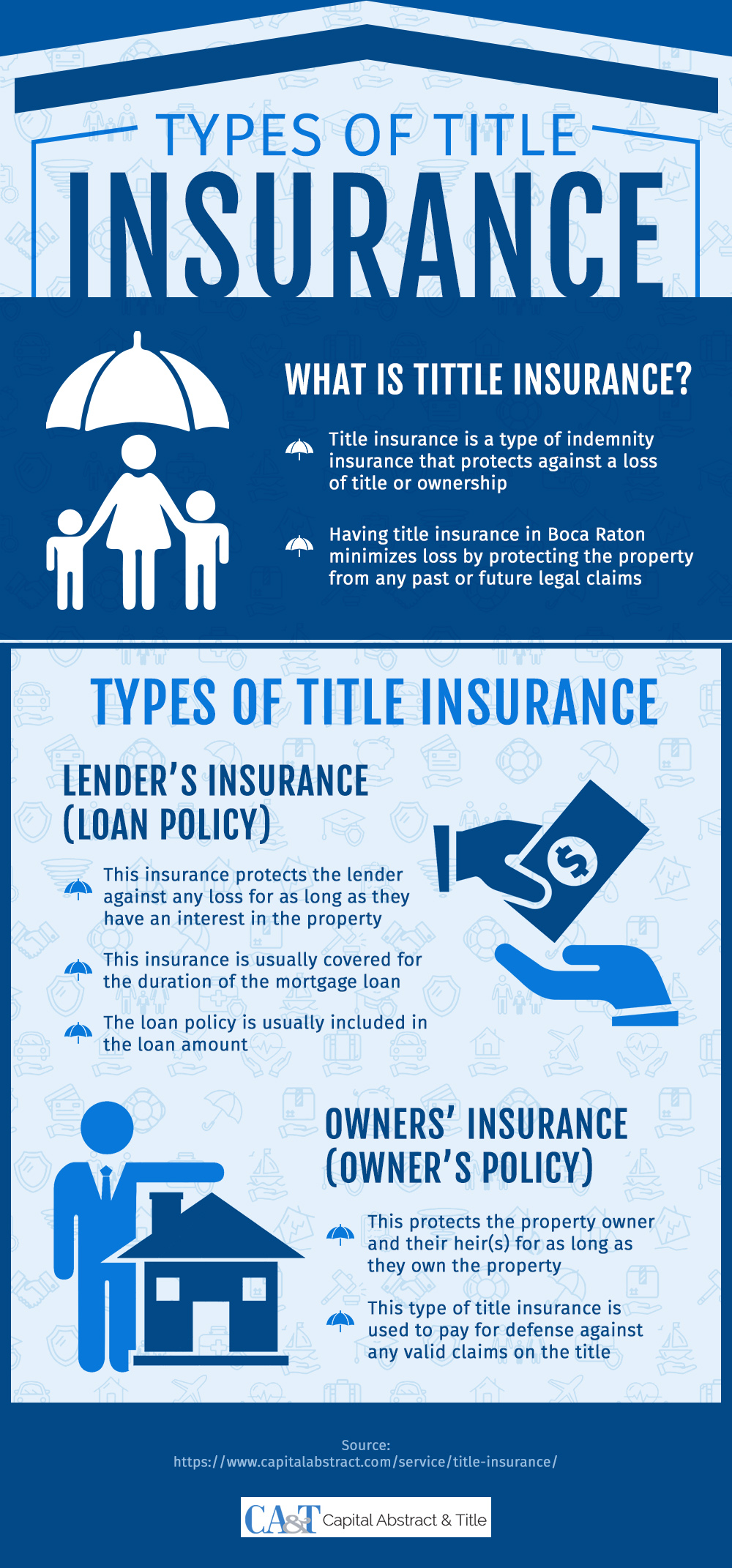

The Infographic below looks at title insurance and the different types that are available in the market to protect property owners against loss of title or ownership. Title insurance is a kind of indemnity that safeguards ownership rights or title of a property.

Two main types of title insurance are lender’s insurance and owner’s insurance. Lender’s Insurance protects against any loss for as long as they have an interest in the property. This kind of Insurance covers all risk through the duration of the mortgage. As an added safety precaution, the loan policy is generally included on the loan amount.

Owner’s insurance, on the other hand, is put in place to protect the interests of property owners and the legal heirs of their property, for as long as the property is owned by them. The primary purpose of an owner’s policy is to pay for legal protection against any valid claims made on the title.

For more information, refer to the infographic below.