If you are selling a property or thinking of buying one, you may have heard of title insurance. Title insurance is a very important tool used to secure your investment and is a requirement for obtaining a mortgage. When buying title insurance, look for a reliable Parkland title insurance company.

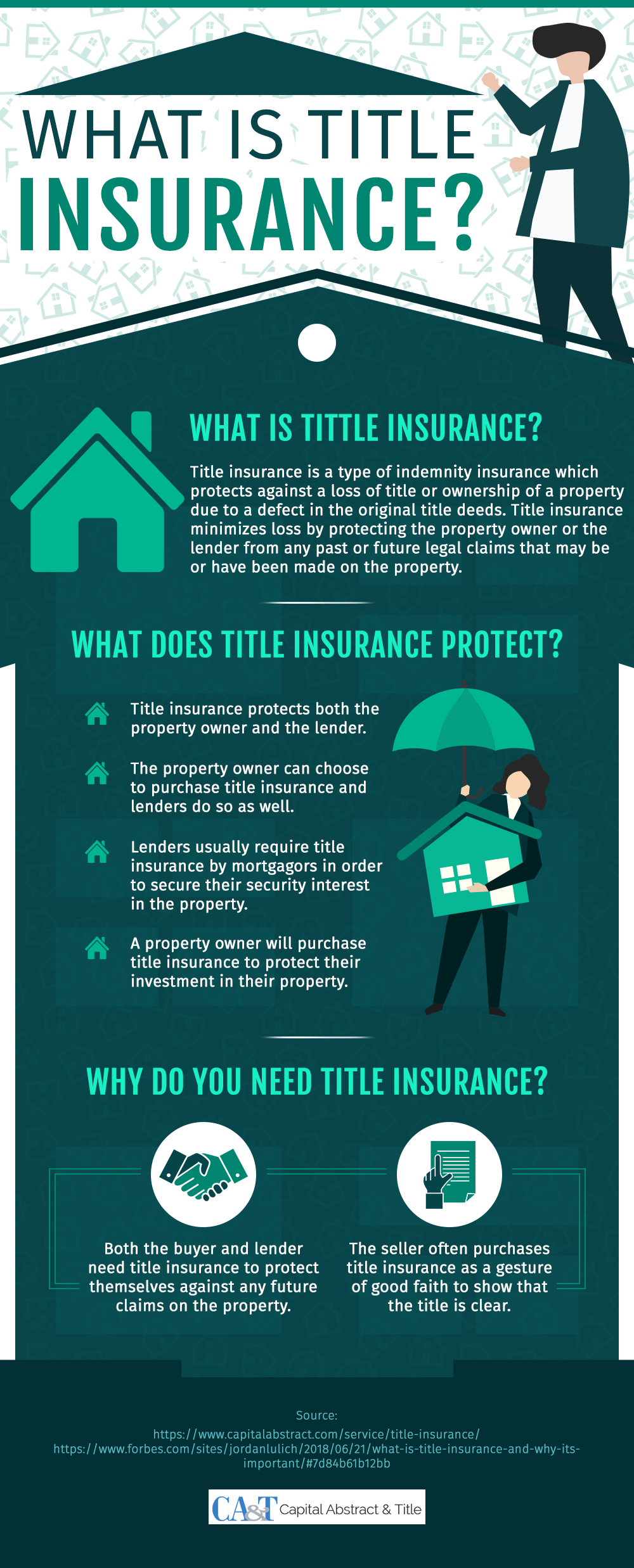

What is title insurance?

The title is evidence of your ownership of the property. When you buy or sell a property, the title is transferred. Every transaction involving property is recorded, whether you buy, sell or take a loan against a property, and is a matter of public record.

Why do I need title insurance?

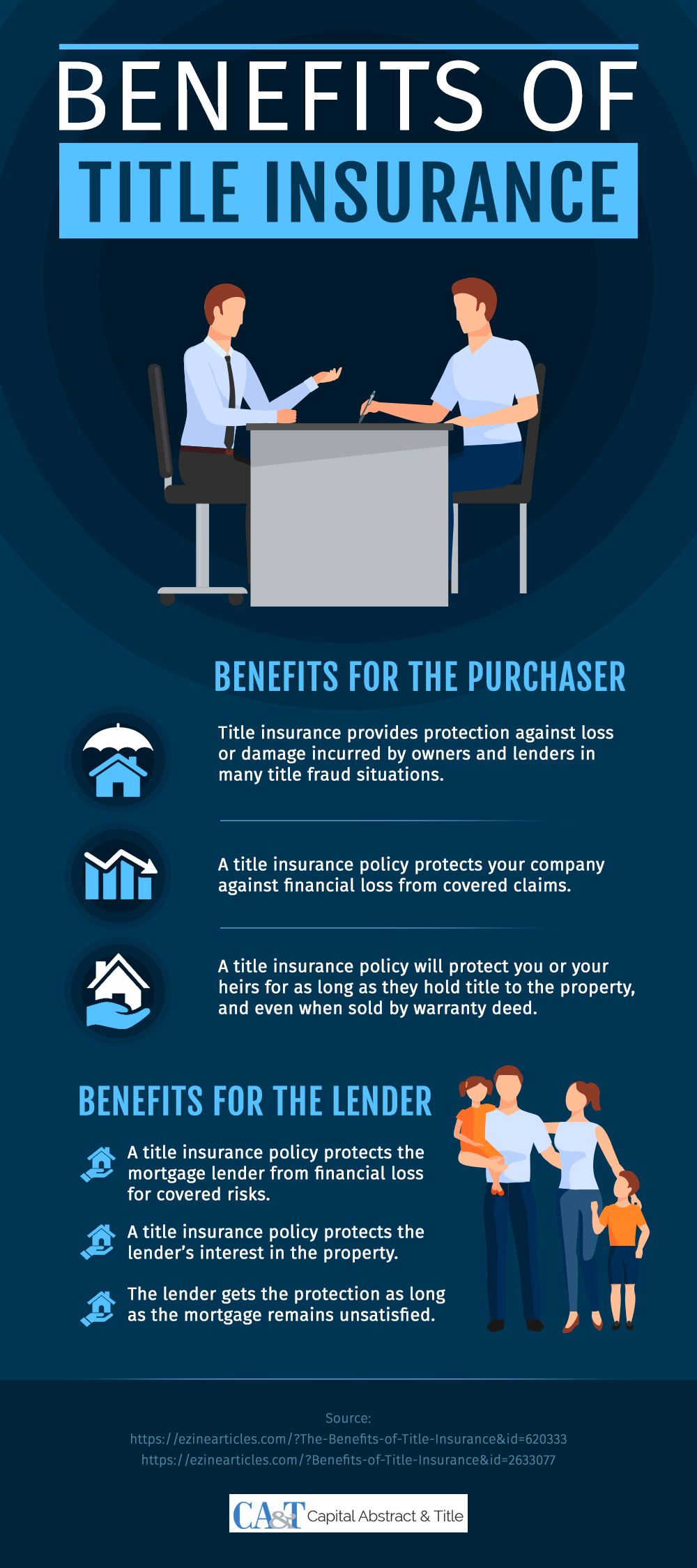

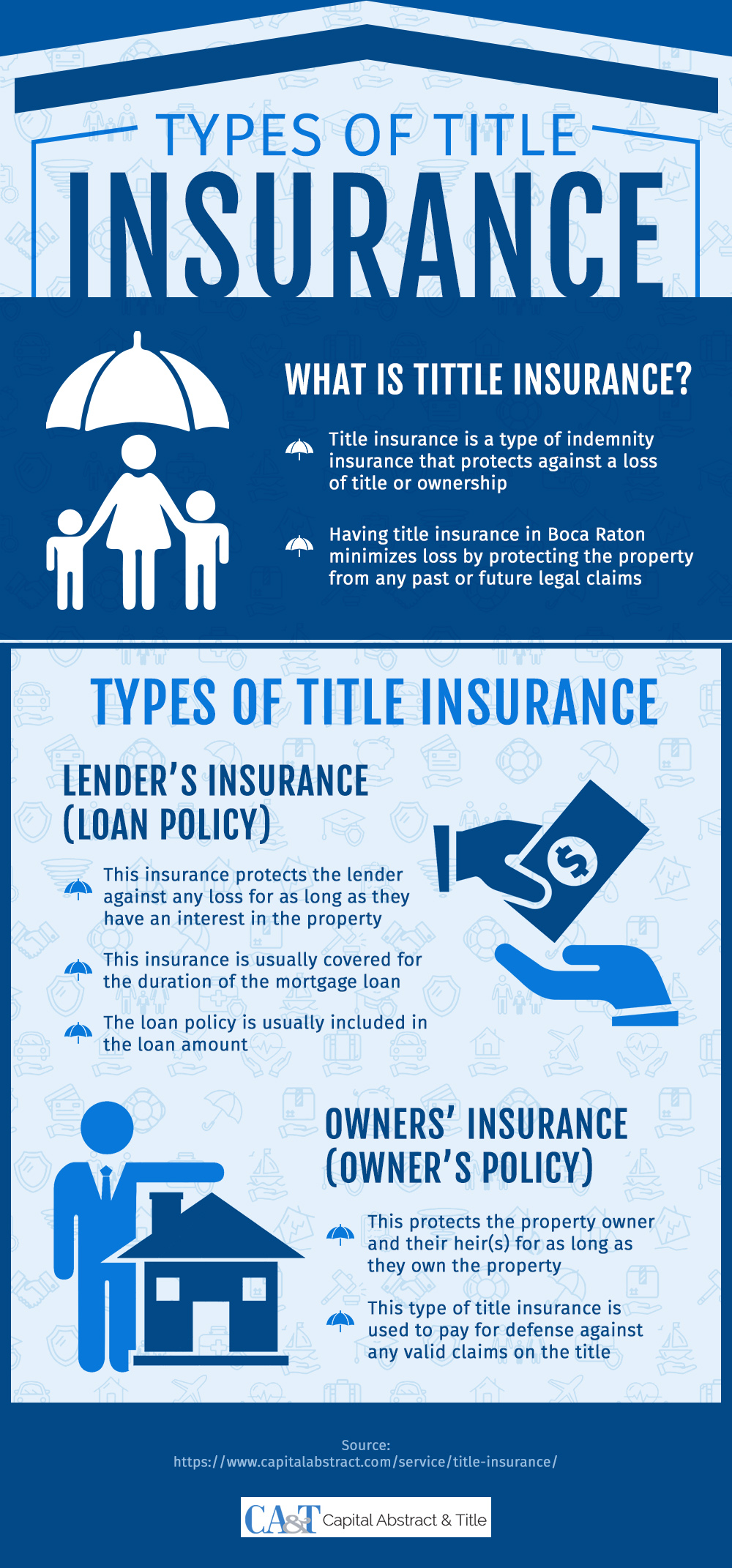

It is possible that your title to the property can be challenged due to some previous issues, such as an outstanding loan against the property or a hitherto unknown claimant. This can jeopardize your investment. Title insurance is a type of indemnity insurance that protects you from any financial loss that arises from successful challenges to the title. It should be noted that it does not restore your ownership, but only protects against financial loss caused by these claims.

How to pick a Parkland title insurance company?

You can search online for a reputable title company. Look for an experienced company, located in your area. A local company will be familiar with the local laws and procedures. Many real estate agents and mortgage companies have title companies they work with, but you aren’t required to use them. You can shop around. Ask about additional add-on fees such as e-recording, notary fee, release tracking, reconveyance fee and so on, that will increase the cost. Above all, choose a company that is financially strong.