If you are someone who has been involved in a real estate transaction, then you will be familiar with title insurance agencies. It is evident that title insurance agencies play an integral role when it comes to real estate transactions. However, several people still have no clear idea on what exactly these companies do.

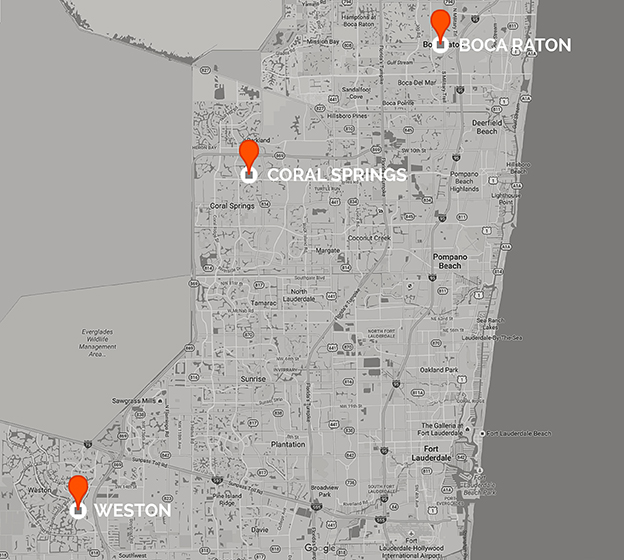

In simple words, title insurance companies simplify the process of real estate transactions by offering complex research and ensuring professional coordination with all parties involved in the transaction. If you want the real estate transaction to go smoothly, it is important to seek the help of title insurance agency Boca Raton.

Records Search

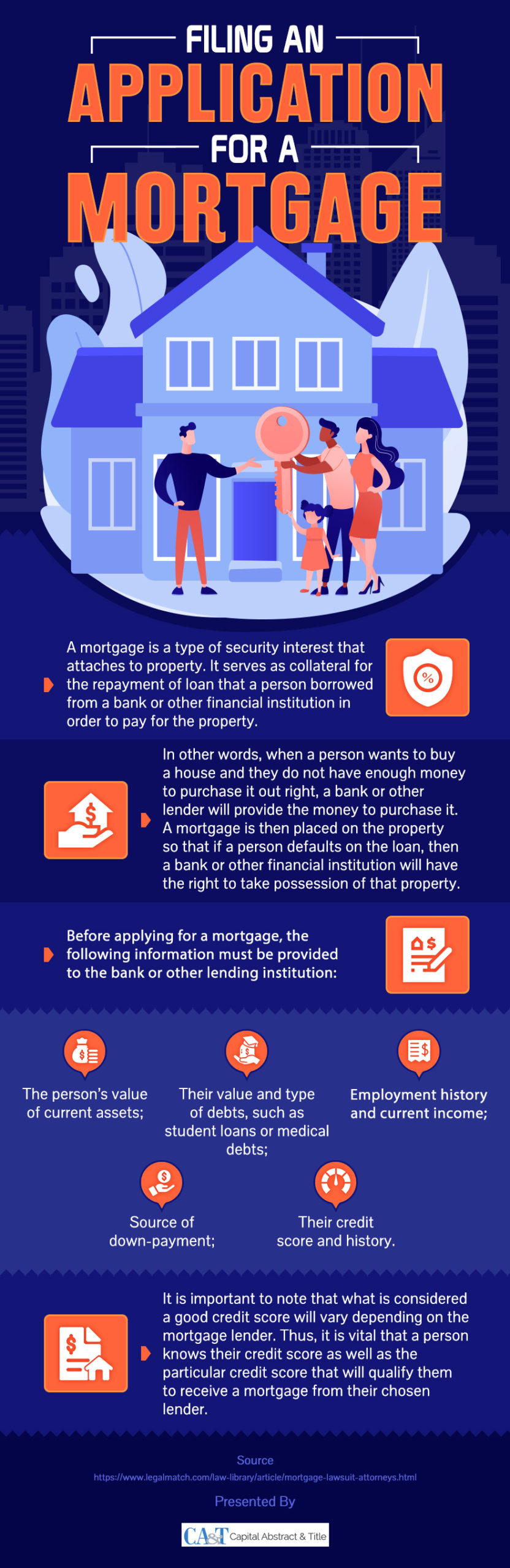

Professional title insurance companies conduct extensive research of country records. The research allows them to identify issues such as property liens, which may be attached to the title of the new property. Title insurance agencies usually consolidate the founded information into the title insurance agreement or preliminary report.

Insurance

Most of the title insurance companies in the country usually offer title insurance to buyers. The insurance coverage will be paying for issues that are identified during the research. The insurance cost is generally built into the real estate property’s closing cost. An important point to remember is that lenders will need title insurance before finalizing the real estate deal.

Closing

In some cases, title insurance agencies will act as escrow officers or closing agents during the purchase of a real estate property. This means that the title insurance company will be representing both the seller and buyer in the transaction.

Final Thoughts

If you are new to the world of real estate transactions or if you want to go the transaction smoothly, it is best to seek the help of title insurance agency Boca Raton, as the agency will help you to ensure that the transaction will go smoothly as planned.